Opm pension calculator

Office of Personnel Management. Retirement Open Retirement Submenu.

Federal Pension Calculator Government Deal Funding

About Open About Submenu Our Agency.

. Since that time new Federal civilian employees who have. Calculator This calculator helps you determine the specific dollar amount to be deducted each pay period. This situation is where the non-federal employee spouse gets 50 of whatever pension you earned while married.

The defined benefit plan applies a pension factor of 15 percent. For example lets say you had a career of 30 years 20 of. Simply know the number of salary payments you have left for the.

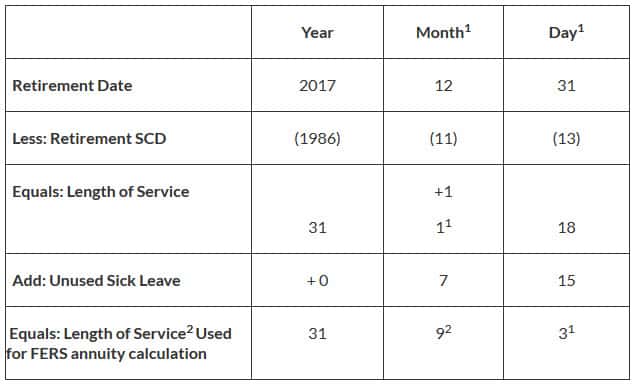

1900 E Street NW. To calculate your RSCD OPM will first look at your SF-50s and determine how many years of service you have accumulated. OPMgov Main Retirement FERS Information Computation Retirement Services FERS Information Your basic annuity is computed based on your length of service and high-3 average salary.

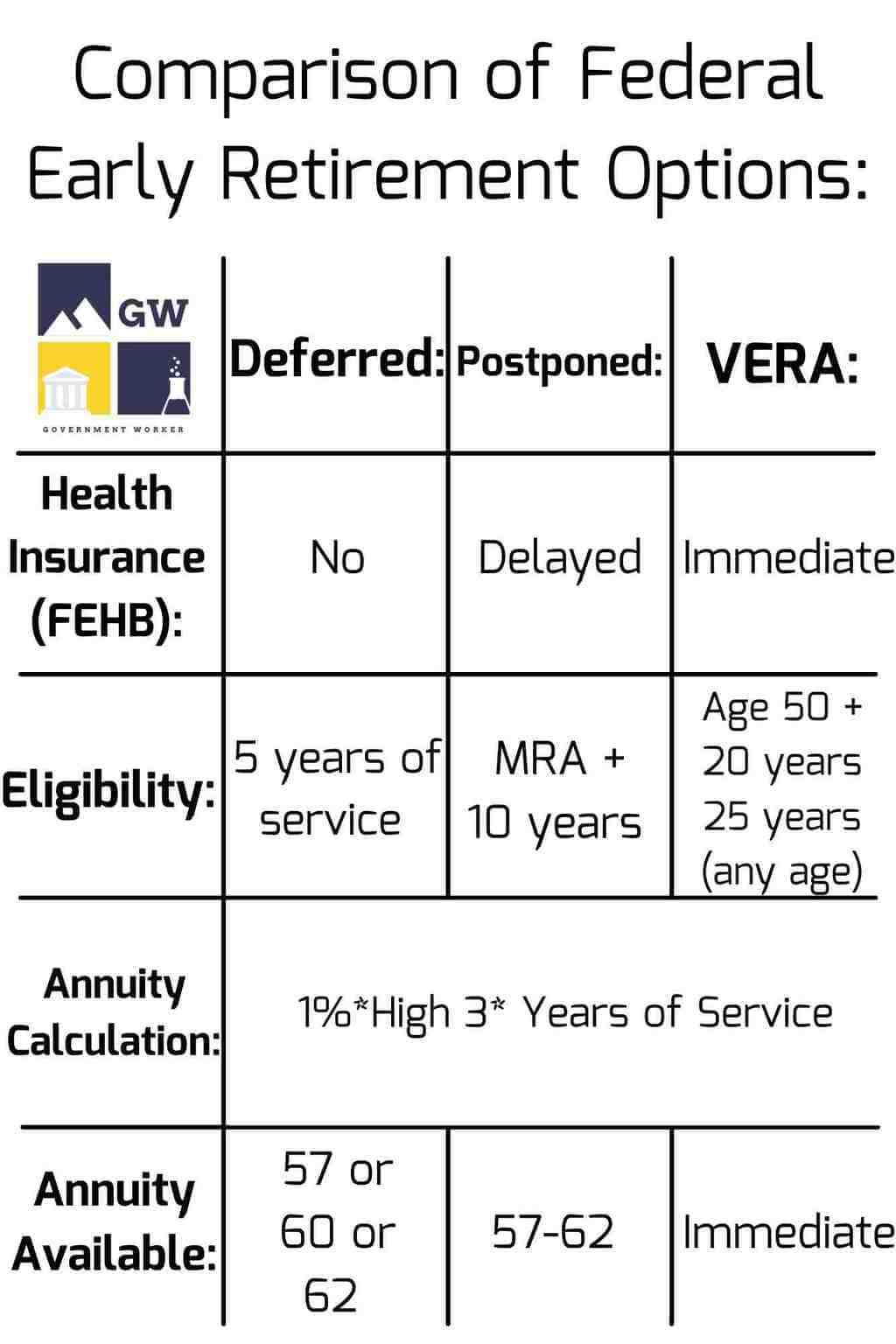

FERS Monthly Pension This amount includes a survivor benefit election of 50 which is the default selection made for married federal. From there you will need to subtract the days of. Congress created the Federal Employees Retirement System FERS in 1986 and it became effective on January 1 1987.

The amount of the annual. Office of Personnel Management. Reduced FERS Basic Benefit FERS Basic Benefit FERS Basic Benefit 62 Current Age 5 So.

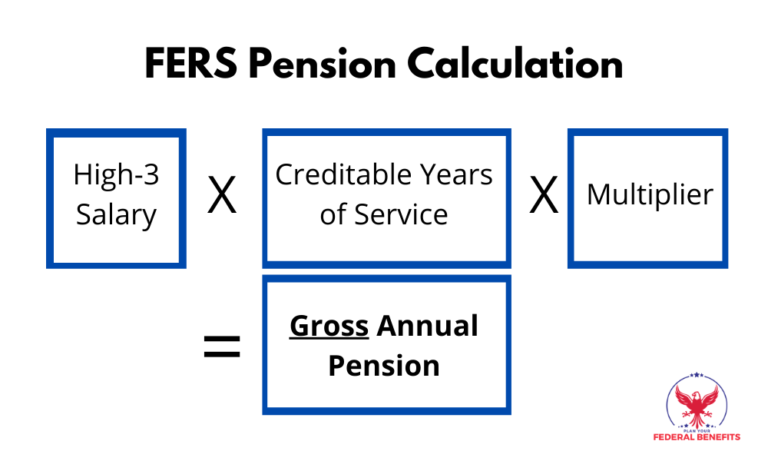

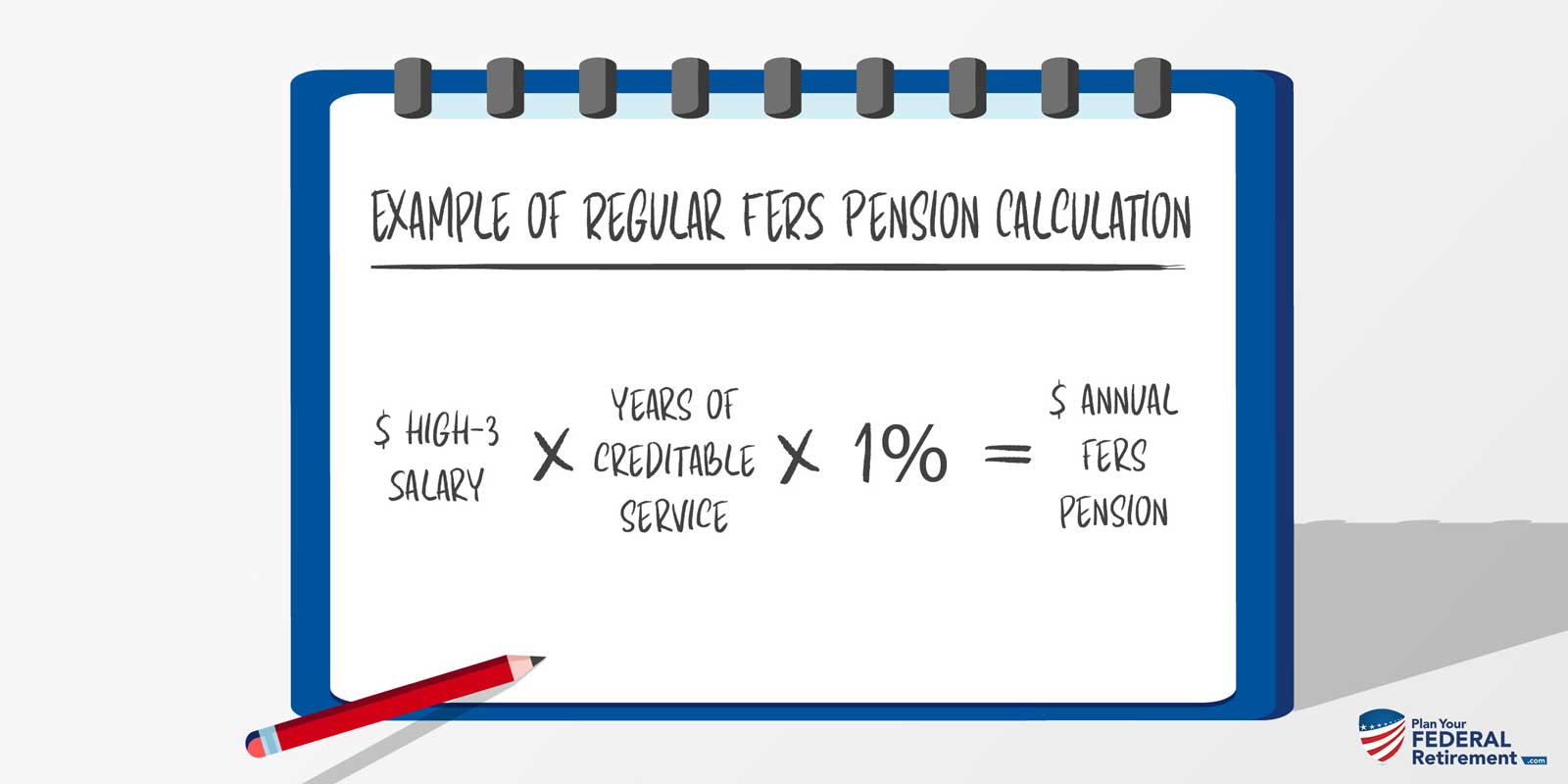

In a mathematical formula your pension benefit would be calculated as. You can contact them for help with your. CSRS employees enter your.

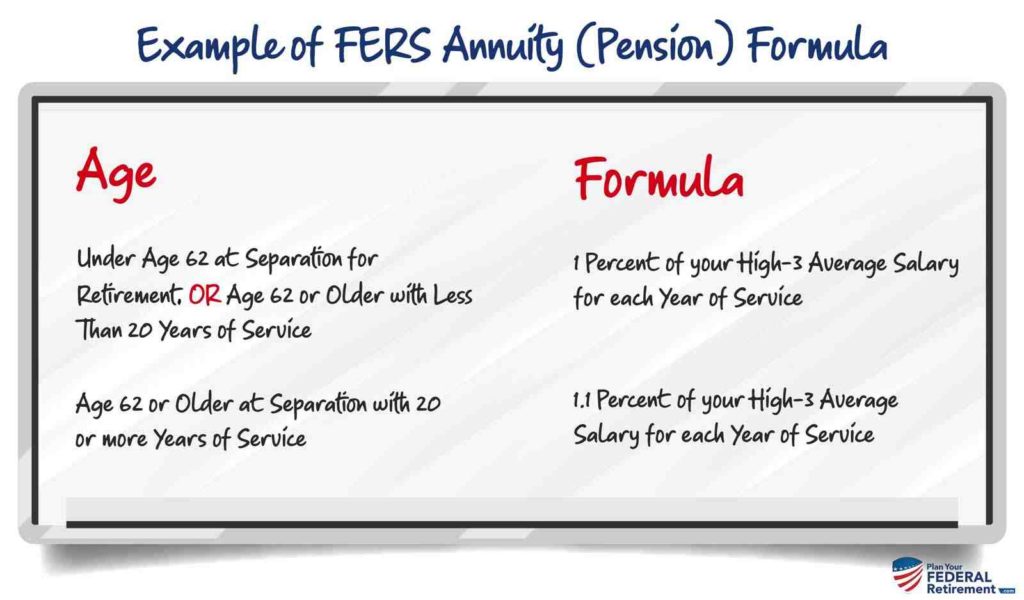

Your multiplier is the easy part of the equation. Multiply 60000 by 15 percent then multiply by 30 years of service. Your multiplier will be 1 unless you retire at age 62 or older with at least 20 years of service at which point your multiplier would be 11 a 10.

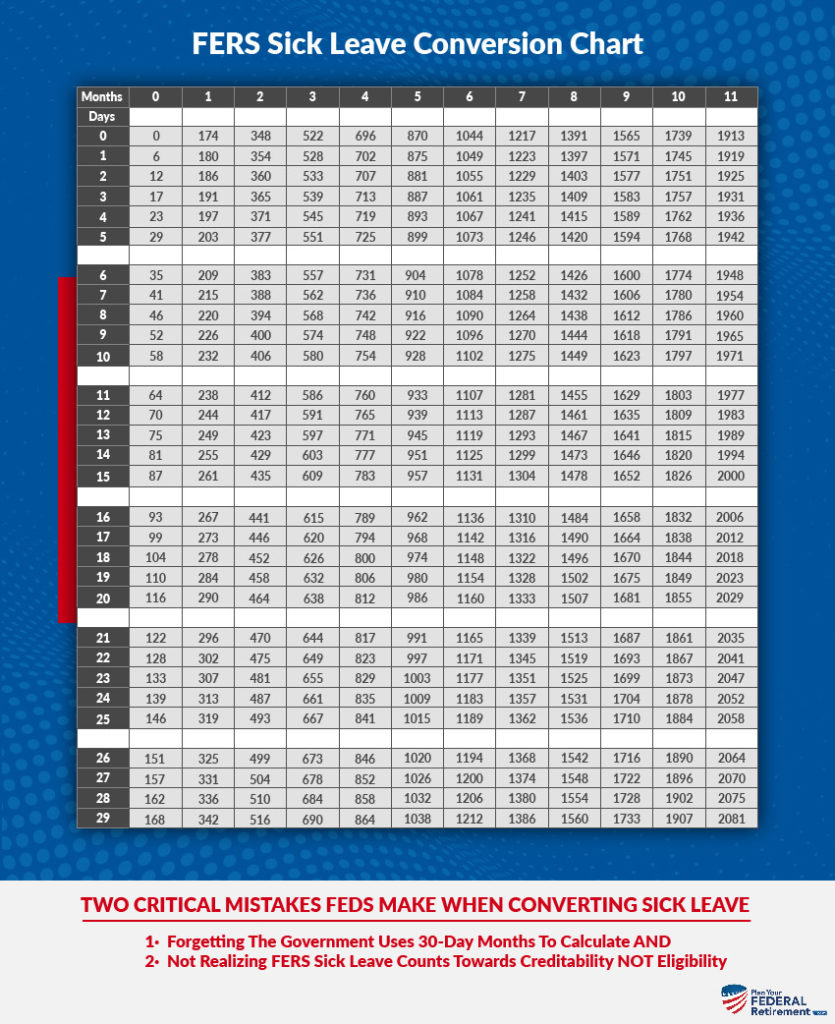

1 OPM uses a 30 day a month 12-month a year calendar 2 Unused sick leave hours equal to difference between sick leave balances on day of transfer to FERS from CSRS and day. This calculator can estimate the annual annuity payments made to participants in the Federal Employees Retirement System or FERS. Taxable portion of your retirement benefit.

Federal Employees Retirement System FERS cost-of-living increases are not provided until age 62 except for disability and survivor benefits. The calculator needs a total of either four or five. The IRS hosts a withholding calculator online tool which can be found on their website.

Estimated Annual TSP Growth PRE-retirement. The average amount is 60000. Calculate your fers amount Est.

300 x 26 7600. If youve retired from the federal government or plan to get to know the Office of Personnel Management OPMs retirement services. 760085000 00918 x 100 92.

Fers Retirement And Sick Leave Plan Your Federal Retirement

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

Start Planning With Our Fers Retirement Calculator Retirement Benefits Institute Retirement Calculator Retirement Benefits Retirement Planner

Can I Take My Fers Pension As A Lump Sum Government Deal Funding

Thanks To Receiving Over 9 000 New Applications Opm S Retirement Backlog Grew Considerably In October Retirement October Thankful

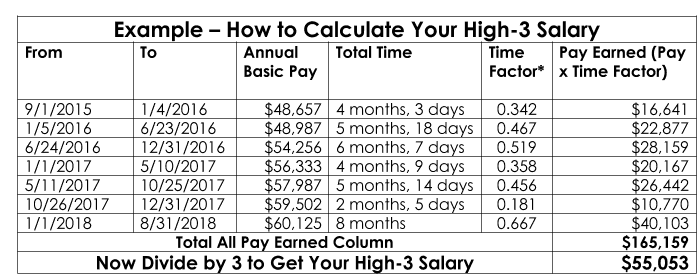

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Retirement Info Center

Fers Retirement Pension Calculator My Federal Plan

Federal Pension Calculator Government Deal Funding

Federal Retirement Calculator Fers Csrs My Federal Retirement

Want Clarity So You Can Retire Watch This Video Csrs Service History And Catch 62 To Exchange Conf Federal Retirement Retirement Benefits Investment Advisor

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Understanding Fers Mra In Our Pension Calculator Retirement Benefits Institute Finance Business Stock Photos Retirement Planner

Fers Retirement Calculator Youtube

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service